Imports are plummeting… should be a good thing… trade imbalance shrinks…. that lifts GDP calculations…. but the problem is…

…. Consumer Demand Has Collapsed.

The state of the U.S. economy is not as difficult as the ‘experts’ always claim. Simple business and checkbook economics always, always, tell you the future. You just have to be willing to accept things as they are, not as you would wish them to be. Let’s have an honest chat. We need it.

Remember, it was November 2021, and no one was paying attention but retail hiring was negative. The month before the 2021 Christmas holiday, when historically businesses would be adding people to their payrolls to support the increase in shopping, and retail businesses did no hiring. In fact, 20,000 retail jobs were LOST the month before Christmas. Retail sales had plummeted. That was a major flare, no one paid attention. Everyone was distracted with the Supply Chain crisis.

Then the fourth quarter 2021 GDP result came in at 6.9%, massively higher than the visible reality on Main Street. The reasoning was identified as a major increase in the value of inventories. While the Biden administration liked the GDP figure, the existence of the unsold inventory was another major flare. Add unsold inventory units to the massive inflationary value of those units (+8%) and you quickly see the +6.9% was bad news, not good news. Major increases in the value of goods have no value unless people are purchasing them. It wasn’t happening. Again, no one (except us) was paying attention.

Then the first quarter of 2022 GDP result came back with a negative 1.6% result. With high inflation those inventories were stagnant. The eight-percentage point GDP swing from the fourth quarter of 2021 to the first quarter of 2022 was another warning flare. Again, no one was truly paying attention. Retail sales -as measured in units purchased- had been in a contracting position since June of 2021, when the stimulus ran out. However, skyrocketing inflation was hiding lower unit sales.

With inventories stagnant, purchase orders to manufacturers stopped. Orders for non-durable consumer goods dropped.

Due to lengthy supply chains, including trans-pacific shipments, the process to stop deliveries in the electronic goods sector takes around 90-days before the drop in retail sales reaches the manufacturer to stop production. Here is the announcement from Samsung: “Samsung Electronics is temporarily halting new procurement orders and asking multiple suppliers to delay or reduce shipments of components and parts for several weeks due to swelling inventories and global inflation concerns, sources have told Nikkei Asia.”

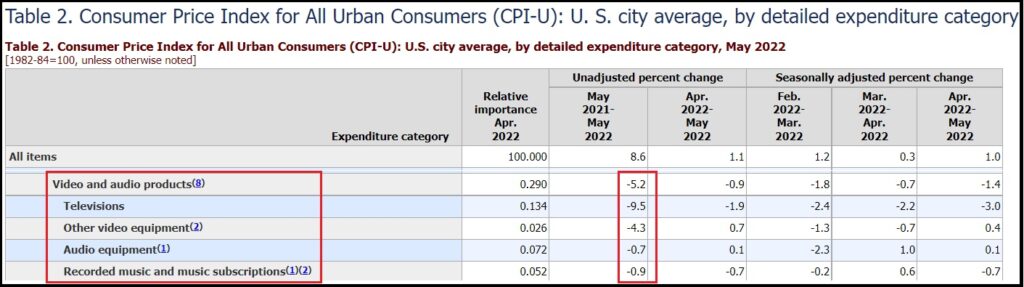

Pay attention to the dates. Prices were dropping because consumers were not spending:

If the USA economy was really in the shape that appeared statistically, you would see it on Main Street. We did see it on Main Street. Consumer purchases of non-essential goods had stalled and contracted. Everyone was paying more for food, energy, housing and fuel. There was/is no room in the household budget to spend on non-essential purchases. People are hunkering down. That was very visible.

When the U.S. consumer stops purchasing goods, the overseas suppliers of those goods need to stop manufacturing and sending them here. As a result, if the economy was in really bad shape, we would expect that imports would drop dramatically. This drop in imports would obviously impact the trade deficit. Well….

WASHINGTON, July 27 (Reuters) – The U.S. trade deficit in goods narrowed sharply in June as exports surged, while business spending on equipment remained strong, reducing the risk that the economy contracted again in the second quarter.

The better-than-expected reports from the Commerce Department on Wednesday left economists scrambling to upgrade their gross domestic product estimates for the last quarter, which had ranged from negative to barely growing. The data were published ahead of the release on Thursday of the advance second-quarter GDP estimate.

[…] The goods trade deficit shrank 5.6% to $98.2 billion, the smallest since last November. Goods exports increased $4.4 billion to $181.5 billion. There were strong gains in exports of food and industrial goods. But fewer capital and consumer goods as well as motor vehicles and parts were exported.

Imports of goods fell $1.5 billion to $279.7 billion. They were pulled down by imports of motor vehicles and food.

[…] The Commerce Department also reported on Wednesday that wholesale inventories increased 1.9% in June, while stocks at retailers rose 2.0%. Retail inventories were boosted by a 3.1% jump in motor vehicle stocks. Excluding motor vehicles, retail inventories increased 1.6%. This component goes into the calculation of GDP.

And here comes the kicker….

[…] According to a Reuters survey of economists, GDP likely increased at a 0.5% annualized rate in the second quarter. The survey was conducted before Wednesday’s data. The economy contracted at a 1.6% pace in the first quarter. Investors have been nervous about another negative quarterly GDP reading, which would mean a technical recession. (read more)

Does that 0.5% look familiar? It should.

From CTH in June: “We can see no political scenario where the Bureau of Economic Analysis (BEA) will report a negative second quarter GDP number, despite the reality of a contracted economy.” … “CTH predicts the BEA is likely to generate a statistical report somewhere in the +0.5% range. Just enough positive GDP to avoid the literal definition of a recession. The BEA report will be issued at the end of July and if they follow recent patterns, they will likely underestimate the inflation rate as well as under-calculate the import data.”

From CTH in July: “CTH has predicted the people within the BEA research group, ie those who make the determinations of GDP, will circle the statistical wagons and generate something akin to a positive 0.5% GDP figure for Q2.“

Three other factors also impact the import data. (1) Operation hide the ships continues (CA regulation issue). (2) There is an ongoing labor dispute with the west coast longshoreman union, and shippers trying to avoid issues are rerouting to Gulf of Mexico and East coast. And (3) There is an ongoing independent truckers strike and protest happening at California ports. All of these provide convenient justifications for lower port data, which, conveniently for the Biden administration, inflates GDP.

The Bureau of Economic Analysis is likely to attribute a 0.5% calculation of GDP (release tomorrow) to the lowering of imports (a deduction to GDP) and then apply a liberal dose of inflation to the value of goods and services created by the economy.

A +0.5% BEA result avoids the pesky technical definition of a recession.

Is there any part of the Federal Government that isn’t totally corrupt by now?

No

There’s only so much makeup you can put on a pig. It’s still a pig

I agree with Joe Biden for the first time. I agree that It isn’t a recession. I think It is a depression.

Inflation is well beyond 20% and it’s going to get worse

Yes we are beginning to hurt, some badly but my in laws went through the real depression and their description of what happened doesn’t even begin to match where we are now. Two families with children lived in the same house my Mother in law was the only one with a job and that was only one story

I bought a slightly modified 1962 Cessna 182 last year for $65k. Original paint job, interior a bit ragged, but the engine only had 440 hours since last overhaul.

I had it repainted, some things fixed, the seats reupholstered, buffed the chrome, repainted the dash, and washed and waxed the hell out of the interior. She shines now!

The insurance company just told me the cost basis of this plane for valuation purposes is now $133k.

I have to say this is almost the best investment I’ve ever made over one short year.

So very tempting to crash it w that value… don’t “fall” for it

(You’re welcome)

It would be worth alot more if you converted it to a hybrid. Strap the batteries under the wings? Regenerate while landing! The prop would act like a windmill. Sorry, just got carried away with the GND. Probably a grant for it! Sorry. Those thoughts just keep coming back as I circle the drain. 😉

“For valuation purposes” is the key phrase. That’s based on how much insurance they want to sell you. It’s not worth $133K until somebody gives you $133K for it. The actual value (what someone will pay you to buy it) will decrease each month for the next 2 years, as demand for expensive “toys” dries up.

But isn’t that important only if you are going to sell the Cessna? You still have to pay all that insurance on the valuation of 133K. How much did it cost you to renovate?

The big difference between now and the late 70’s is then we had people like Reagan who called it out and had a plan to fix it. Now we have nothing but liberal uniparty republicans who couldn’t find their ass with both hands and who wouldn’t know how to fix this or would want to fix this if they had to.

They site consumer health because of consumer spending. What they do not recognize, and they should, is that consumers are buying now to save money in the future because they expect continued severe inflation for an extended period. But all these anticipatory purchases will not be made in the future, which would happen in the normal course, and future purchases will dry up in a very big way. In short, after the inflation anticipatory spending is complete, consumer spending will dry up for a long period of time. Business sales and margins will decline, and people will be laid off. The recession may well turn into a depression.

why are the meds gone? Is there a demand?

Well……we always wanted to “starve the beast”. I guess this is doing it…albeit involuntarily.

The ONLY thing that’s going to get the attention of the Washington DC corruption czars is a complete economic collapse. That could very well be in our future.

But are they not passing a huge Green New Deal a la Joe Mannequin/Chuck Fumer?

Only more government spending can save us now.

Buy low, sell high. There will be many opportunities to “buy low” from now to 2025, due to the bottom dropping out of the market, due to weak demand. Real estate is the best example. There will be many foreclosure deals to be found in 2023-24.

you have to have money to make money. Yes, just like in the Great Depression and the Weimar Republic of Germany, some people benefited. But overall, people lost nearly everything and suffered for many, many, years.

Consumer buying will continue to plummet. Anyone but a blue blood democrat with multiple houses, vehicles and planes is now suffering. This was the intention not a side effect. The Obamacrats running DC will do everything they can to completely obliterate the middle class If we lose this coming election, I fear that as a nation we are finished. I’m so thankful that I read and listened to the comments section here six months ago. Several very bright people told us to stock up. Stock up on staples, beans, rice. My little great granddaughters were helping me yesterday. They started calling the east side of my garage “Costco’. I thank God every day that I was raised by Dust Bowl Okies who had lived through the Depression.

PMI indicates we’re in a recession. Never heard the word mentioned during Trumps tenure.

Sawbuck days the husk takes credit for fixing the port back ups.